As filed with the Securities and Exchange Commission on February 10, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in its Charter)

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification No.) |

Telephone:

(Address, including zip code, and telephone number,

including area code, of principal executive offices)

Richard Brown

Interim Chief Executive Officer

Odyssey Semiconductor Technologies, Inc.

9 Brown Road

Ithaca, NY 14850

Telephone: (607) 351-9768

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

| Mitchell Lampert, Esq. | Brett R. Hanson, Esq. |

| Anna Jinhua Wang, Esq. | Emily Humbert, Esq. |

| Robinson & Cole LLP | Fox Rothschild LLP |

| 1055 Washington Blvd. | 222 S. Ninth Street, Suite 2000 |

| Stamford, CT 06901 | Two22 Building |

| Telephone: (203) 462-7559 | Minneapolis, MN 55402-3338 |

| Telephone: (612) 607-7100 |

Approximate date of commencement of proposed sale to public: As soon as practicable on or after the effective date of this registration statement.

1

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company

| |

| Emerging growth company

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

2

The information in this prospectus is not complete and may be changed. These securities may not be sold until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| Preliminary Prospectus | Subject to Completion, dated February 10, 2022 |

Odyssey Semiconductor Technologies, Inc.

Shares of Common Stock

This is a firm commitment underwritten public offering of shares of common stock, par value $.0001 per share (the “Common Stock”), of Odyssey Semiconductor Technologies, Inc. (“Odyssey” or the “Company”), based on an assumed public offering price of $ per share, based on the last reported sales price of our Common Stock on , 2022.

Our Common Stock is presently quoted on the OTCQB Market (the “OTCQB”) under the stock ticker symbol of “ODII” since August 27, 2020. There is currently limited trading activity of our Common Stock. We plan to apply to list our Common Stock on the Nasdaq Capital Market under the symbol of “ODII”. No assurance can be given that our listing application will be approved. If our Common Stock is not approved for listing on Nasdaq Capital Market, we will not consummate this offering.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements.

Investing in our Common Stock is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page 13 of this prospectus for a discussion of information that should be considered before making a decision to purchase our Common Stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per | ||||||||

| Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. Does not include a non-accountable expense allowance equal to 1.0% of the public offering payable to Maxim Group LLC. |

We have granted the underwriter an option to purchase up to an additional $[●] of shares of Common Stock (equal to 15% of the shares of Common Stock sold in the offering) from us at the public offering price less the underwriting discounts and commissions, and on the same terms and conditions as set forth above, for 45 days after the date of this prospectus. If the underwriter exercises the option in full, the total public offering price will be $[●], the total underwriting discounts and commissions will be $[●], and the total proceeds, before expenses, to us will be $[●].

The underwriters expect to deliver the shares of Common Stock to the purchasers on or about , 2022.

Sole Book Running Manager

Maxim Group LLC

The date of this prospectus is February 10, 2022.

3

TABLE OF CONTENTS

4

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Additional risks and uncertainties not presently known or that are currently deemed immaterial may also impair our business operations. The risks and uncertainties described in this document and other risks and uncertainties which we may face in the future will have a greater impact on those who purchase our Common Stock. These purchasers will purchase our Common Stock at a specified fixed price, at the market price or at a privately negotiated price, and will run the risk of losing their entire investments.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of this prospectus. Because it is a summary, it does not contain all of the information that you should consider in making your investment decision. Before investing in our Common Stock, you should read the entire prospectus carefully, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

When used herein, unless the context requires otherwise, references to the “Company,” “we,” “our” and “us” refer to Odyssey Semiconductor Technologies, Inc., a Delaware corporation, collectively with its wholly-owned subsidiary, Odyssey Semiconductor, Inc, a Delaware corporation.

About the Company

Odyssey Semiconductor Technologies, Inc. (the “Company”) was formed as a Delaware corporation on April 12, 2019. The Company acquired its wholly-owned subsidiary, Odyssey Semiconductor, Inc., a Delaware corporation (“Odyssey Semiconductor”), on June 21, 2019 through a share exchange. Odyssey Semiconductor, formed on April 11, 2019, commenced business operations on June 17, 2019 when it acquired its wholly-owned subsidiary, JR2J LLC (“JR2J”), from its founders, Richard Brown and James Shealy, in exchange for shares of Odyssey Semiconductor.

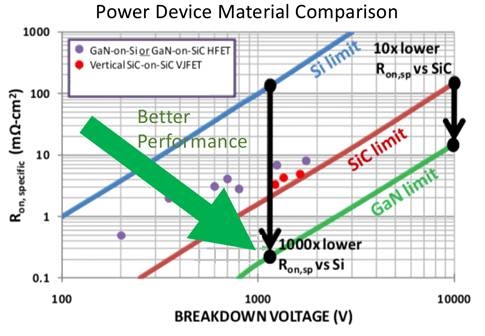

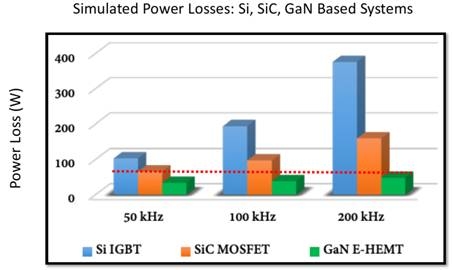

The Company is a semiconductor device company developing high-voltage power switching components and systems based on proprietary Gallium Nitride (GaN) processing technology. The premium power switching device market, which is described as applications where silicon-based (Si) systems currently perform less efficiently, is projected to reach over $3.5 billion by 2025 and is currently dominated by the semiconductor materials silicon (Si) and silicon carbide (SiC). GaN-based systems outperform Si and SiC based systems in every way due to the superior material properties of GaN. However, GaN devices have, to-date proven difficult to process using standard semiconductor processing methods that are used to create Si and SiC based devices. We have developed a novel processing modification that allows GaN to be processed in a manner that for the first time, makes high voltage GaN power switching devices both technically viable as well as reliable and manufacturable. Our mission is to disrupt the rapidly growing premium power switching device market using with our newly developed GaN high voltage power transistor for switching applications.

5

Overview of The Semiconductor Industry

The semiconductor industry was formed in 1960 when the production of semiconductors became a viable option. The global semiconductor market has grown rapidly, from over $1 billion in 1964 to $425.96 billion in 2020 and projected to grow to $803.15 billion by 2028.

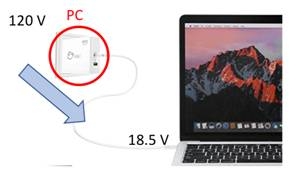

The application of semiconductors has expanded extensively from radio in the 1960s to crucial electronic components nowadays to all manufactured products with computing or power management capabilities, ranging from computers and personal electronics to automotive goods and heavy machinery. Semiconductor devices mounted inside many electronics appliances are important electronic components that support our everyday lives.

Integrated circuits (ICs) and electronic discrete components such as diodes (which are two-terminal electronic components that conduct current primarily in one direction) and transistors (which are devices possessing an amplification function) are made of semiconductors.

The semiconductor industry is divided into six broad categories based on the end-use application:

| ● | Data processing: This comprises chips used in servers, computers, printers, and related hardware. This is the largest segment where semiconductors are used. However, growth in this segment has moderated, and no breakthrough innovation is expected in the near future. | |

| ● | Communications: This comprises chips used in wired and wireless communication equipment such as smartphones, tablets, and broadband equipment. This segment is growing at a faster pace. | |

| ● | Consumer electronics: This comprises chips used in household appliances, LCD TVs, and gaming consoles. | |

| ● | Industrial: This comprises chips used in scanning devices such as bar code scanners and point-of-sale terminals, medical devices such as patient monitors and ultrasound imaging, and power supply equipment. | |

| ● | Automotive: This comprises chips used in electronic automotive components such as power steering and lighting. | |

| ● | Military and civil aerospace: This is a specialized segment where integrated circuits related to a particular application are built. |

Advantage and Market Focus of the Company

Semiconductors are materials which have a conductivity between conductors (generally metals), which has full conductivity, and nonconductors or insulators (such as most ceramics), which has negligible conductivity. The conductivity of a semiconductor material may be altered in useful ways by the deliberate, controlled introduction of impurities into the crystal structure of the material to modulate its electrical, optical and structural properties. This process is known as doping.

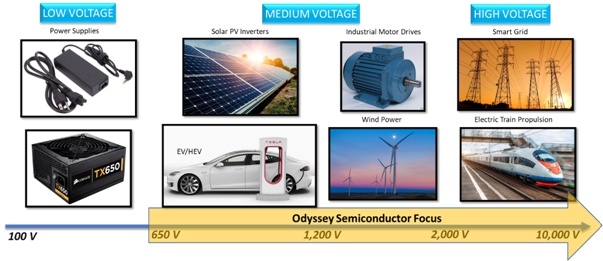

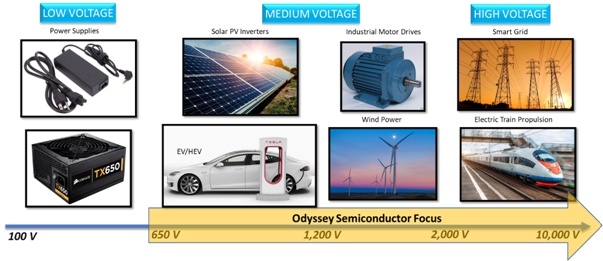

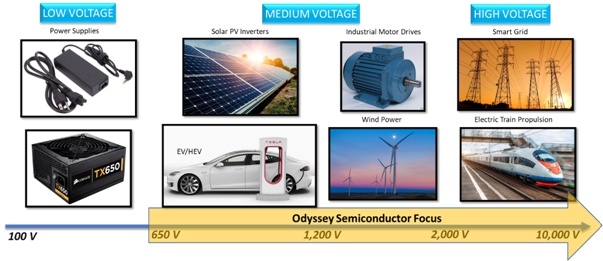

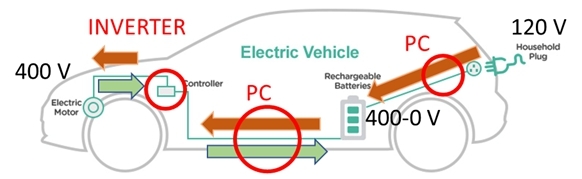

Silicon (Si) is traditionally the most common semiconductor material. However, Si-based systems have proven to perform inadequately. We described the applications where Si-based systems perform inadequately as the premium power switching device market, which was $571 million in 2018 and is projected to pass $5 billion by 2029. This growth is largely driven by the rapid adoption of electric vehicles (EV) and hybrid electric vehicles (HEV) and the growing number of installations of renewables such as solar and wind power as well as increased demand for more efficient industrial motor drives.

The premium power switching device market is currently dominated by the semiconductor material SiC. GaN-based systems outperform Si and SiC based systems in every way due to the superior material properties of GaN. However, GaN devices have, to-date proven difficult to process using standard semiconductor processing methods that are used to create Si and SiC based devices. While GaN can be implanted with ions through doping process like any other semiconductor, unlike Si or SiC, the temperature required to activate the ions in GaN destroys the crystal, making implant and activate scheme impractical in the GaN material. The Company is working on developing proprietary technology that allows activation of dopants in the GaN. This proprietary technology allows GaN to be processed in a manner that for the first time makes high voltage GaN power switching devices viably manufacturable.

6

The Company expects that its GaN power products will overlap the current market for SiC power switching market. Furthermore, the Company expects that its GaN power products will exceed switching speeds and operating voltages currently attainable reliably with SiC.

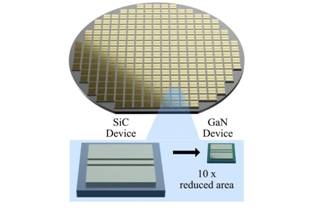

GaN is both less expensive to produce and offers significant performance advantages over SiC in system efficiency and system size. Currently there are no GaN devices in the market with ratings more than 1,000 V, which will be our strength area, however, our products will address voltages as low as 650 V.

Competition

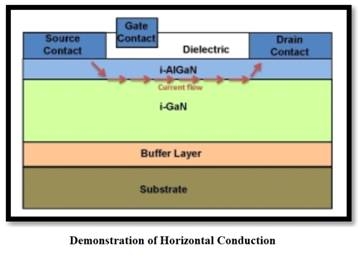

There are many horizontal-conduction (meaning the current flows horizontally, along the surface of the wafer), high-electron-mobility transistor (HEMT) products emerging from industry. HEMT transistors are able to operate at higher frequencies than ordinary transistors, up to millimeter wave frequencies, and are used in high-frequency products such as cell phones, satellite television receivers, voltage converters, and radar equipment. However, horizontal-conduction device technology has difficulty scaling beyond 650 V.

In contrast to horizontal-conduction devices, vertical-conduction (meaning the current flows from the top surface of the wafer to the bottom surface) devices could easily have scaling beyond 650 V; however, there are currently few discrete parts available with ratings above 650 V, and none above 1,000 V. The Company believes it is uniquely poised to enter into the >1,000 V device market and above with its vertical conduction device technology.

We expect that our competitors will include a number of larger companies, particularly in the SiC area (such as STMicro, WolfSpeed, Texas Instruments (TI), On Semiconductor, and etc.) which have more substantial research and development budgets than us. Even smaller companies which are more targeted in their development efforts, such as Nexgen Power Systems, Inc., may be our potential competitors. If we are unable to compete effectively with our competitors, our products or technologies may be rendered obsolete or noncompetitive, which could materially adversely affect our business and results of operations.

7

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and, for as long as we continue to be an “emerging growth company,” we intend to take advantage of certain exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. In addition, as an “emerging growth company,” we have chosen to take advantage of the extended transition period for complying with new or revised accounting standards, which will allow us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. Accordingly, our financial statements may not be comparable to companies that comply with all public company accounting standards which could impact the valuation of our securities.

Corporate Information

Our office address is 9 Brown Road, Ithaca, NY 14850; telephone: (607) 351-9768.

Our corporate website address is https://www.odysseysemi.com/. Information accessed through our website is not incorporated into this prospectus and is not a part of this prospectus.

Summary of Risk Factors

Investing in our Common Stock involves a high degree of risk. Below is a summary of material factors that make an investment in our Common Stock speculative or risky. Importantly, this summary does not address all the risks that we face. These risks include, but are not limited to, the following and are discussed more fully in the section titled “Risk factors”:

Risks Relating to Our Business, Growth Prospects and Operating Results

| ● | We face risks related to health epidemics and other outbreaks, which could significantly disrupt our operations and could have a material adverse impact on us. The recent coronavirus outbreak could materially and adversely affect our business. | |

| ● | We are recently formed and are currently operating at a loss. Our lack of operating history makes it difficult to evaluate our business and prospects and may increase the risks associated with an investment in our shares of Common Stock. | |

| ● | Our business depends substantially on the continuing efforts of our executive officers and our business may be severely disrupted if we lose their services. | |

| ● | We may be unable to attract and retain highly skilled personnel. | |

| ● | There may be limitations on the effectiveness of our internal controls. Failure of our internal control over financial reporting could harm our business and financial results. | |

| ● | Our management team has limited experience managing a public company. | |

| ● | We depend on a limited number of customers and the loss of one or more of these customers could have a material adverse effect on our business, financial condition and results of operations. | |

| ● | If we do not have access to capital on favorable terms, on the timeline we anticipate, or at all, our financial condition and results of operations could be materially adversely affected. | |

| ● | We may not obtain insurance coverage to adequately cover all significant risk exposures. | |

| ● | If product liability lawsuits are brought against us, we may incur substantial liabilities. | |

| ● | We will be dependent on the services of third-party suppliers and contract manufacturers. | |

| ● | We may be subject to litigation from time to time during the normal course of business, which may adversely affect our business, financial condition and results of operations. | |

Risks Related to the Semiconductor Industry

| ● | The semiconductor industry is highly competitive, and our inability to compete effectively could materially adversely affect our business and results of operations. | |

| ● | The semiconductor industry has experienced rapid consolidation and our inability to compete with large competitors or failure to identify attractive opportunities to consolidate may materially adversely affect our business. | |

| ● | The semiconductor industry is highly cyclical, and significant downturns or upturns in customer demand can materially adversely affect our business and results of operations. |

8

| ● | Rapid innovation and short product life cycles in the semiconductor industry can result in price erosion of older products, which may materially adversely affect our business and results of operations. | |

| ● | Shortages or increased prices of raw materials could materially adversely affect our results of operations. | |

| ● | If we are unable to protect the intellectual property we use, our business, results of operations and financial condition could be materially adversely affected. | |

| ● | We may be unable to maintain manufacturing efficiency, which could have a material adverse effect on our results of operations. | |

| ● | If we are unable to identify and make the substantial research and development investments required to remain competitive in our business, our business, financial condition and results of operations may be materially adversely affected. | |

| ● | Our products are based on novel Gallium Nitride (GaN) processing technology, which makes it difficult to predict the time and cost of product development. | |

| ● | Changes in tariffs or other government trade policies may materially adversely affect our business and results of operations, including by reducing demand for our products. |

Risk related to our Common Stock

| ● | We may not be able to maintain a listing of our Common Stock on Nasdaq. | |

| ● | If our Common Stock fails to maintain a listing on a national exchange such as Nasdaq, it may be considered a “penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell. | |

| ● | The shares of our Common Stock may experience dilution by exercises of outstanding warrants and options. | |

| ● | There are a significant number of shares of Common Stock eligible for sale, which could depress the market price of such shares. | |

| ● | You will experience immediate and substantial dilution as a result of this offering. | |

| ● | We are an “emerging growth company,” and will be able take advantage of reduced disclosure requirements applicable to “emerging growth companies,” which could make our Common Stock less attractive to investors. | |

| ● | Our officers and directors have significant control over shareholder matters. | |

| ● | Our officers have broad discretion in the use of proceeds. | |

| ● | We do not currently intend to pay dividends on our Common Stock in the foreseeable future, and consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our Common Stock. |

9

The Offering

| Common Stock to be offered: | [●] shares of Common Stock ([●] shares if the underwriters exercise their over-allotment option in full) | |

| Assumed public offering price: | $ per share, based on the last reported sales price of our Common Stock on , 2022 | |

| Common stock outstanding immediately before this offering: | 12,726,911 shares of Common Stock (1) | |

| Common stock to be outstanding after this offering: | [●] shares (or [●] shares if the underwriters exercise their over-allotment option in full) (2) | |

| Over-allotment option: | We have granted to the underwriters a 45-day option to purchase from us up to an additional 15% of the shares of Common Stock sold in the offering, solely to cover over-allotments, if any, at the initial public offering price, less the underwriting discounts. | |

| Underwriter’s warrants | We have agreed to issue to the underwriter warrants to purchase a number of shares of Common Stock equal in the aggregate to 5% of the total number of shares issued in this offering. The underwriter’s warrants will be exercisable at a per share exercise price equal to 110% of the public offering price per share of Common Stock sold in this offering. The underwriter’s warrants are exercisable at any time and from time to time, in whole or in part, during the four-and-a-half-year period commencing six months after the closing of this offering. The registration statement of which this prospectus forms a part also registers the issuance of the shares of Common Stock issuable upon exercise of the underwriter’s warrants. See “Underwriting” for more information. | |

| Use of Proceeds: | We estimate that the net proceeds from this offering will be approximately $[●] million (or approximately $[●] if the underwriters exercise their over-allotment option in full), after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering primarily for general corporate purposes, including working capital, funding the expansion of our business. See “Use of Proceeds” on page 32 of this prospectus. | |

| Proposed trading market and symbol: | Our Common Stock is presently quoted on the OTCQB under the stock ticker symbol of “ODII”. In connection with this offering, we plan to file an application to list our shares of Common Stock under the symbol “ODII” on the Nasdaq Capital Market. No assurance can be given that our listing application will be approved. The closing of this offering is contingent upon the successful listing of our Common Stock as on the Nasdaq Capital Market. | |

| Risk Factors: | An investment in our company is highly speculative and involves a significant degree of risk. See “Risk Factors” starting on page 13 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our Common Stock. | |

| Lock-up: | We, all of our directors, officers and holders of three percent (3%) or more of our shares of Common Stock have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our Common Stock or securities convertible into or exercisable or exchangeable for our Common Stock for a period of six months after the closing of this offering. See “Underwriting” for more information. |

| (1) | As of February 10, 2022, excludes: (i) 155,966 shares of Common Stock underlying warrants, each exercisable at a price of $1.50 per share, issued to Katalyst Securities LLC, the placement agent in our August 2019 Private Placement; (ii) 89,730 shares of our Common Stock underlying warrants, each exercisable at a price of $4.00 per share, issued to GP Nurmenkari Inc., the placement agent in our March 2021 Private Placement; and (iii) 1,398,246 shares of Common Stock issuable upon exercise of options granted under our 2019 Equity Compensation Plan. |

| (2) | Excludes: (i) all the warrants and options included in footnote (1) above, and (ii) Underwriter’s Warrants issued pursuant to this offering. |

10

SUMMARY FINANCIAL DATA

The following tables set forth our summary historical financial data as of, and for the periods ended on, the dates indicated. The summary statements of operations data for the years ended December 31, 2020 and the summary balance sheet data as of December 31, 2020 are derived from our audited financial statements and notes that are included elsewhere in this prospectus. The summary statements of operations data for the nine months ended September 30, 2021 and the summary balance sheet data as of September 30, 2021 are derived from our unaudited interim financial statements and notes that are included elsewhere in this prospectus. We have prepared the unaudited financial statements in accordance with generally accepted accounting principles (GAAP) and on the same basis as the audited financial statements, and have included all adjustments, consisting of only normal recurring adjustments that, in our opinion, we consider necessary for a fair statement of the financial information set forth in those statements. Our historical results are not necessarily indicative of our results in any future period and results from our interim period may not necessarily be indicative of the results of the entire year.

The following summary financial data should be read together with the information under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes appearing elsewhere in this prospectus. The summary financial data in this section are not intended to replace our financial statements and the related notes and are qualified in their entirety by the financial statements and related notes included elsewhere in this prospectus.

| For The Nine Months Ended September 30, | ||||||||

| 2021 (unaudited) | 2020 (unaudited) | |||||||

| Revenues | $ | 693,074 | $ | 1,102,071 | ||||

| Cost of Revenues | 792,239 | 1,106,569 | ||||||

| Gross Loss | (99,165 | ) | (4,498 | ) | ||||

| Operating Expenses: | ||||||||

| Research and development | 1,073,737 | 430,592 | ||||||

| Selling, general, and administrative | 1,658,994 | 869,643 | ||||||

| Total Operating Expenses | 2,732,681 | 1,300,235 | ||||||

| Loss from Operations | (2,831,846 | ) | (1,304,733 | ) | ||||

| Other Income (Expense): | ||||||||

| Forgiveness of PPP loan and other income | 238,719 | 1 | ||||||

| Interest expense | (14,407 | ) | — | |||||

| Total Other Income (Expense) | 224,312 | 1 | ||||||

| Net Loss | $ | (2,607,534 | ) | $ | (1,304,732 | ) | ||

| For the years ended | ||||||||

| December 31, | ||||||||

| 2020 | 2019 | |||||||

| Revenues | $ | 1,374,420 | $ | 719,851 | ||||

| Cost of Revenues | 1,453,005 | 589,640 | ||||||

| Gross (Loss) Profit | (78,585 | ) | 130,211 | |||||

| Operating Expenses: | ||||||||

| Research and development | 607,148 | 155,527 | ||||||

| Selling, general, and administrative | 1,354,069 | 1,434,089 | ||||||

| Total Operating Expenses | 1,961,217 | 1,589,616 | ||||||

| Loss From Operations | (2,039,802 | ) | (1,459,405 | ) | ||||

| Other Income (expense): | ||||||||

| Interest income (expense), net | (3,306 | ) | 1,236 | |||||

| Net Loss | $ | (2,043,108 | ) | $ | (1,458,169 | ) | ||

11

| September 30, | December 31, | |||||||

| 2021 (unaudited) | 2020 | |||||||

| Assets | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 3,409,429 | $ | 272,705 | ||||

| Contract assets | — | 62,273 | ||||||

| Accounts receivable | 48,045 | 10,877 | ||||||

| Deferred expenses | 4,941 | 185,084 | ||||||

| Prepaid expenses and other current assets | 35,261 | 33,569 | ||||||

| Total Current Assets | 3,497,676 | 564,508 | ||||||

| Restricted cash | 103,188 | 103,149 | ||||||

| Property and equipment, net | 894,967 | 986,407 | ||||||

| Total Assets | $ | 4,495,831 | $ | 1,654,064 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 119,205 | $ | 187,046 | ||||

| Loan payable – short term | 77,278 | 53,858 | ||||||

| Deferred revenue | 30,000 | 260,447 | ||||||

| Total Current Liabilities | 226,483 | 501,351 | ||||||

| Loans payable – long term | 554,853 | 621,600 | ||||||

| Total liabilities | 781,336 | 1,122,951 | ||||||

| Stockholders’ Equity: | ||||||||

| Preferred stock, $0.0001 par value, 5,000,000 shares authorized; 0 shares issued and outstanding as of September 30, 2021 and December 31, 2020, respectively | — | — | ||||||

| Common stock, $0.0001 par value, 45,000,000 shares authorized, 12,726,911 and 11,429,661 shares issued and outstanding as of September 30, 2021 and December 31, 2020, respectively | 1,272 | 1,143 | ||||||

| Additional paid-in capital | 9,837,157 | 4,046,370 | ||||||

| Accumulated deficit | (6,123,934 | ) | (3,516,400 | ) | ||||

| Total Stockholders’ Equity | 3,714,495 | 531,113 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 4,495,831 | $ | 1,654,064 | ||||

12

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements,” which include information relating to management’s current view with respect to future events, future financial performance, financial projections, strategies, expectations, competitive environment and regulation. Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking statements. Such forward-looking statements may include projections with respect to market size and acceptance, revenues and earnings, marketing and sales strategies, and business operations. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved. Forward-looking statements are based on information we have when those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| ● | our limited operating history; | |

| ● | our current and future capital requirements; | |

| ● | our dependence on business and consumer requirements for the products that we offer; | |

| ● | our ability to develop products to satisfy changing customer demands or regulatory requirements; | |

| ● | our ability to maintain and/or protect the validity of our intellectual property; | |

| ● | our ability to retain key executive members; | |

| ● | our ability to attract and retain highly skilled personnel | |

| ● | our dependence on a limited number of customers; | |

| ● | the accuracy of our estimates regarding expenses and capital requirements; | |

| ● | our ability to adequately support growth; | |

| ● | the competitive nature of the semiconductor industry; | |

| ● | our ability to identify and make the substantial research and development investments; and | |

| ● | the availability and affordability of raw materials. |

All forward-looking statements included in this prospectus are based on information available to us on the date of this prospectus. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this prospectus.

The market in which the Company intends to operate in is a highly competitive business environment. The Company’s business is and will continue to be affected by government regulation, economic, political and social conditions, and consumer response to new and existing products and services, technological developments and, particularly in view of new technologies, the ability to protect intellectual property rights. The Company’s actual results could differ materially from management’s expectations because of changes in such factors. Other factors and risks could also cause actual results to differ from those contained in forward-looking statements. Due to such uncertainties and the risk factors set forth herein, prospective investors are cautioned not to place undue reliance upon such forward-looking statements.

RISK FACTORS

An investment in our Common Stock is speculative and involves a high degree of risk, including the risk of a loss of your entire investment. You should carefully consider the risks and uncertainties described below and the other information contained in this prospectus before purchasing shares of our Common Stock. If any of the following risks actually materialize, our business, financial condition, prospects and/or operations could suffer. In such event, the value of our Common Stock could decline, and you could lose all or a substantial portion of the money that you pay for our Common Stock. The risks and uncertainties described below are not the only ones we are facing. Additional risks and uncertainties not presently known to us or that we deem immaterial may also impair our business operations or financial condition.

13

Risks Relating to Our Business, Growth Prospects and Operating Results

We face risks related to health epidemics and other outbreaks, which could significantly disrupt our operations and could have a material adverse impact on us. The recent coronavirus outbreak could materially and adversely affect our business.

An outbreak of a new respiratory illness caused by coronavirus disease 2019 (“ COVID-19”) has resulted in millions of infections and hundreds of thousands of deaths worldwide as of the date of filing of this prospectus, and continues to spread across the globe, including within the United States. The outbreak of COVID-19 or by other epidemics could materially and adversely affect our business, financial condition and results of operations. If the spread of the virus worsens in regions in which we have material operations or sales, our business activities originating from affected areas, including sales, manufacturing and supply chain related activities, and could be adversely affected. Disruptive activities could include the temporary closure of our facilities and those used in our supply chain processes, restrictions on the shipment of our products, business closures in impacted areas, and restrictions on our employees’ and consultants’ ability to travel and to meet with customers. If workers at one or more of our offices or the offices of our suppliers or manufacturers become ill or are quarantined and in either or both events are therefore unable to work, our operations could be subject to disruption. Further, if our manufacturers become unable to obtain necessary raw materials or components, we may incur higher supply costs or our manufacturers may be required to reduce production levels, either of which may negatively affect our financial condition or results of operations.

As events are rapidly changing, we do not know how long the COVID-19 pandemic and the measures that have been introduced to respond to it will disrupt our operations or the full extent of that disruption. Further, once we are able to restart normal business hours and operations doing so may take time and will involve costs and uncertainty. We also cannot predict how long the effects of COVID-19 and the efforts to contain it will continue to impact our business after the pandemic is under control. Governments could take additional restrictive measures to combat the pandemic that could further impact our business or the economy in the geographies in which we operate. It is also possible that the impact of the pandemic and response on our suppliers, customers and markets will persist for some time after governments ease their restrictions. These measures have negatively impacted, and may continue to impact, our business and financial condition as the responses to control COVID-19 continue.

We are recently formed and are currently operating at a loss. Our lack of operating history makes it difficult to evaluate our business and prospects and may increase the risks associated with an investment in our shares of Common Stock.

The Company was recently formed in 2019 and is currently operating at a loss. Therefore, the Company is subject to the risks involved with any speculative early-stage enterprise. There is no assurance that the Company will successfully offer, market and distribute its products or services. The Company may continue to experience net losses and negative cash flows from operations or become only marginally profitable. The time required to reach substantial profitability is highly uncertain. There is no assurance that the Company will be able to achieve substantial profitability or that profitability, if achieved, can be sustained on an ongoing basis. There is no assurance that actual cash requirements will not exceed our estimates. Such risks for the Company include, but are not limited to:

| ● | an evolving, unpredictable and unproven business model; | |

| ● | an intensely competitive developing market; | |

| ● | rapidly changing technology and unpredictable characteristics of materials and processes; | |

| ● | managing growth; | |

| ● | dependence on key personnel; | |

| ● | limited operating capital and limited access to credit; and | |

| ● | other unforeseen changes and developments. |

14

In order to address these risks, the Company must, among other things:

| ● | implement and successfully execute its business strategy; | |

| ● | provide superior customer service; | |

| ● | respond to competitive developments; | |

| ● | attract, retain and motivate qualified personnel; and | |

| ● | respond to unforeseen and changing circumstances. |

The Company cannot assure investors that it will succeed in addressing these risks.

Our business depends substantially on the continuing efforts of our executive officers and our business may be severely disrupted if we lose their services.

Our future success depends substantially on the continued services of our executive officers. We do not maintain key man life insurance on any of our executive officers and directors. If one or more of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Under such circumstances our business may be severely disrupted and we may incur additional expenses attempting to recruit and retain new officers.

We may be unable to attract and retain highly skilled personnel.

Our success depends on our ability to attract, motivate and retain highly skilled personnel, including research, technical, marketing, management and staff personnel. In the semiconductor industry, the competition for qualified personnel, particularly experienced design engineers and other technical employees, is intense, particularly when the business cycle is improving. During such periods, competitors may try to recruit our most valuable technical employees. Moreover, there can be no assurance that we will be able to retain our current personnel or recruit the key personnel we require. Loss of the services of, or failure to effectively recruit, qualified personnel, including senior managers, could have a material adverse effect on our competitive position and on our business.

There may be limitations on the effectiveness of our internal controls. Failure of our internal control over financial reporting could harm our business and financial results.

Proper systems of internal controls over financial accounting and disclosure are critical to the operation of a public company. Our management is responsible for establishing and maintaining effective internal control over financial reporting. Internal control over financial reporting is a process to provide reasonable assurance regarding the reliability of financial reporting for external purposes in accordance with accounting principles generally accepted in the United States. Internal control over financial reporting includes maintaining records that in reasonable detail accurately and fairly reflect our transactions; providing reasonable assurance that transactions are recorded as necessary for preparation of the financial statements; providing reasonable assurance that receipts and expenditures of our assets are made in accordance with management authorization; and providing reasonable assurance that unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements would be prevented or detected on a timely basis. Any failure to maintain an effective system of internal control over financial reporting could limit our ability to report our financial results accurately and timely or to detect and prevent fraud.

As we are a start-up company and a new public company, we are at the very early stages of establishing, and we may be unable to effectively establish such systems. This would leave us without the ability to reliably assimilate and compile financial information about the Company and significantly impair our ability to prevent error and detect fraud, all of which would have a negative impact on the Company from many perspectives. Moreover, we do not expect that disclosure controls or internal control over financial reporting, even if established, will prevent all error and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. Failure of our control systems to prevent error or fraud could materially adversely impact us.

15

In connection with the evaluation of our internal control over financial reporting as of December 31, 2020 that was undertaken by management in connection with the preparation of our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and as of September 30, 2021 for our Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, management determined that our lack of segregation of duties constituted a material weakness as of December 31, 2020 and September 30, 2021. In addition, we do not have a Chief Financial Officer and sufficient resources in the Company’s accounting function, which restricts the Company’s ability to gather, analyze and properly review information related to financial reporting. Those functions are currently performed by our Interim Chief Executive Officer, Richard Brown. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that a reasonable possibility exists that a material misstatement of our annual or interim financial statements would not be prevented or detected on a timely basis. The Company is considering various remediation methods to mitigate such material weakness, but has not yet adopted or implemented any plan to remedy such deficiency.

We may be unable to complete our analysis of our internal controls over financial reporting in a timely manner, or these internal controls may not be determined to be effective, which may adversely affect investor confidence in our company and, as a result, the value of our Common Stock.

We are required, pursuant to Section 404 of the Sarbanes-Oxley Act, to furnish a report by our management on, among other things, the effectiveness of our internal control over financial reporting for each fiscal year. This assessment will need to include disclosure of any material weaknesses identified by our management in our internal control over financial reporting, as well as a statement that our independent registered public accounting firm has issued an opinion on our internal control over financial reporting.

If we are unable to assert that our internal control over financial reporting is effective, or, if applicable, our independent registered public accounting firm is unable to express an opinion on the effectiveness of our internal controls, we could lose investor confidence in the accuracy and completeness of our financial reports, which would cause the price of our Common Stock to decline, and we may be subject to investigation or sanctions by the SEC. We will also be required to disclose changes made in our internal control and procedures on a quarterly basis.

However, our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting pursuant to Section 404 until the date we are no longer an “emerging growth company” as defined in the recently enacted JOBS Act, if we continue to take advantage of the exemptions contained in the JOBS Act. We will remain an “emerging growth company” for up to five years, although if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time, we would cease to be an “emerging growth company” as of the following December 30.

At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating. Our remediation efforts may not enable us to avoid a material weakness in our internal control over financial reporting in the future. Any of the foregoing occurrences, should they come to pass, could negatively impact the public perception of our company, which could have a negative impact on our stock price.

Our management team has limited experience managing a public company.

Most members of our management team have limited experience managing a publicly-traded company, interacting with public company investors and complying with the increasingly complex laws pertaining to public companies. Our management team may not successfully or efficiently manage the Company as a public company subject to significant regulatory oversight and reporting obligations under the federal securities laws and the continuous scrutiny of securities analysts and investors. These obligations and constituents will require significant attention from our senior management and could divert their attention away from the day-to-day management of our business, which could adversely affect our business, financial condition and operating results.

16

We depend on a limited number of customers and the loss of one or more of these customers could have a material adverse effect on our business, financial condition and results of operations.

During the period ended September 30, 2021 and the year ended December 31, 2020, approximately 28% and 85% of revenues respectively were generated from one governmental entity pursuant to our contract with such entity, which contract was completed in 2021. One client accounted for approximately 32% of revenues for the nine months ended September 30, 2021. No other client accounted for more than 10% of revenues. 0% and 100% of contract assets as of September 30, 2021 and December 31, 2020, respectively, are also related to this governmental client. Deferred costs and deferred revenues at September 30, 2021 and December 31, 2020 relate to several different clients, of which one client represents more than 75% of both categories at December 30, 2020.

Due to the concentration of revenues from a limited number of customers, if we do not receive the payments expected from any of these major customers, our revenue, results of operation and financial condition will be negatively impacted.

In addition, we cannot assure that any of our customers in the future will not cease purchasing products or services from us in favor of products or services produced by other suppliers, significantly reduce orders or seek price reductions in the future, and any such event could have a material adverse effect on our revenue, profitability, and results of operations.

Furthermore, if a significant portion of our revenue is derived from customers in certain industries, a downturn or lower sales to customers in such industries could materially adversely affect our business and results of operations.

If we do not have access to capital on favorable terms, on the timeline we anticipate, or at all, our financial condition and results of operations could be materially adversely affected.

We currently anticipate that our current cash on hand, grant revenue and customer payments will be sufficient to fund our operations for the next 12 months. However, we anticipate that we will routinely incur significant costs to conduct research and development, implement new manufacturing and information technologies, to increase our productivity and efficiency, to upgrade equipment and to expand production capacity. There can be no assurance that we will realize a return on the capital expended. We also anticipate incurring material amounts of debt to fund these requirements in the future. Significant volatility or disruption in the global financial markets may result in us not being able to obtain additional financing on favorable terms, on the timeline we anticipate, or at all, and we may not be able to refinance, if necessary, any outstanding debt when due, all of which could have a material adverse effect on our financial condition. We currently have no commitments for any additional capital and there can be no assurance that we will receive any such commitments, or that any commitments for capital will be on terms that are acceptable to us. Any inability to obtain additional funding on favorable terms, on the timeline we anticipate, or at all, may cause us to curtail our operations significantly, reduce planned capital expenditures and research and development, or obtain funds through arrangements that management does not currently anticipate, including disposing of our assets and relinquishing rights to certain technologies, the occurrence of any of which may significantly impair our ability to remain competitive. If our operating results falter, our cash flow or capital resources prove inadequate, or if interest rates increase significantly, we could face liquidity problems that could materially and adversely affect our results of operations and financial condition.

If our estimates related to expenditures and/or expected revenue are inaccurate, our business may fail.

The success of our business is dependent in part upon the accuracy of our management’s estimates of expenditures and revenue for the next 12 months and beyond. If such estimates are inaccurate or we encounter unforeseen expenses and delays or significant unexpected reduction of revenue, we may not be able to carry out our business plan, which could result in the failure of our business.

If the Company cannot effectively manage growth by implementing and improving its operational and financial systems, the Company’s business, prospects, financial condition and results of operations could be materially adversely affected.

In order to maximize the potential growth in the Company’s market opportunities, the Company may have to expand rapidly and significantly. The impetus for expansion could place a significant strain on the management, operational and financial resources of the Company. In order to manage growth, the Company will be required to implement and continually improve its operational and financial systems, expand operations, attract and retain superior management and train, manage and expand its employee base. The Company can give no assurance that it will effectively manage its operations that its system, procedures, or controls will adequately support operations or that management of the Company will successfully implement its business plan. If the Company cannot effectively manage growth, the Company’s business, prospects, financial condition and results of operations could be materially adversely affected.

17

We may not obtain insurance coverage to adequately cover all significant risk exposures.

We will be exposed to liabilities that are unique to the products we provide. There can be no assurance that we will acquire or maintain insurance for certain risks, that the amount of our insurance coverage will be adequate to cover all claims or liabilities, or that we will not be forced to bear substantial costs resulting from risks and uncertainties of business. It also may not be possible to obtain insurance to protect against all operational risks and liabilities. The failure to obtain adequate insurance coverage on terms favorable to us, or at all, could have a material adverse effect on our business, financial condition and results of operations.

If product liability lawsuits are brought against us, we may incur substantial liabilities.

We face a potential risk of product liability as a result of any of the products that we develop, manufacture and/or offer for sale. For example, we may be sued if any product we develop, manufacture and/or sell allegedly causes injury or is found to be otherwise unsuitable during product testing, manufacturing, marketing or sale. Any such product liability claims may include allegations of defects in manufacturing, defects in design, a failure to warn of dangers inherent in the product, negligence, strict liability and a breach of warranties. Claims could also be asserted under state consumer protection acts. If we cannot successfully defend ourselves against product liability claims, we may incur substantial liabilities. Even successful defense would require significant financial and management resources. Regardless of the merits or eventual outcome, liability claims may result in:

| ● | decreased demand for products that we may offer for sale; | |

| ● | injury to our reputation; | |

| ● | costs to defend the related litigation; | |

| ● | a diversion of management’s time and our resources; | |

| ● | substantial monetary awards to trial participants or patients; and | |

| ● | product recalls, withdrawals or labeling, marketing or promotional restrictions. |

We currently do not maintain any product liability insurance. We may obtain product liability insurance in the future. However, there is no guarantee that we will be able to obtain product liability insurance or that such insurance will be affordable or sufficient. If we are unable to obtain or retain sufficient product liability insurance coverage, it could prevent or inhibit the commercialization of products we develop. Even if we obtain product liability insurance in the future, we may have to pay amounts awarded by a court or negotiated in a settlement that exceed our coverage limitations or that are not covered by our insurance, and we may not have, or be able to obtain, sufficient capital to pay such amounts.

Warranty claims, product liability claims and product recalls could harm our business, results of operations and financial condition.

Manufacturing semiconductors is a highly complex and precise process, requiring production in a tightly controlled, clean environment. Minute impurities in our manufacturing materials, contaminants in the manufacturing environment, manufacturing equipment failures, and other defects can cause our products to be non-compliant with customer requirements or otherwise nonfunctional. We face an inherent business risk of exposure to warranty and product liability claims in the event that our products fail to perform as expected or such failure of our products results, or is alleged to result, in bodily injury or property damage (or both). In addition, if any of our designed products are or are alleged to be defective, we may be required to participate in their recall. A successful warranty or product liability claim against us in excess of our available insurance coverage, if any, and established reserves, or a requirement that we participate in a product recall, could have material adverse effects on our business, results of operations and financial condition. Additionally, in the event that our products fail to perform as expected or such failure of our products results in a recall, our reputation may be damaged, which could make it more difficult for us to sell our products to existing and prospective customers and could materially adversely affect our business, results of operations and financial condition.

18

Since a defect or failure in our product could give rise to failures in the goods that incorporate them (and claims for consequential damages against our customers from their customers), we may face claims for damages that are disproportionate to the revenue and profits we receive from the products involved. We plan to attempt to limit our liability through our standard terms and conditions of sale and other customer contracts in certain instances; however, there is no assurance that such limitations will be effective. To the extent that we are liable for damages in excess of the revenue and profits we received from the products involved, our results of operations and financial condition could be materially adversely affected.

A significant product defect or product recall could materially and adversely affect our brand image, causing a decline in our sales and profitability, and could reduce or deplete our financial resources.

Provided we are successful in developing and selling our products, any product defect could materially harm our brand image and could force us to conduct a product recall. This could damage our relationships with our customers. A product recall would be particularly harmful to us because we will likely have limited financial and administrative resources to effectively manage a product recall and it would detract management’s attention from implementing our core business strategies. As a result, a significant product defect or product recall could cause a decline in our sales and profitability and could reduce or deplete our financial resources.

We will be dependent on the services of third-party suppliers and contract manufacturers, and any disruption in or deterioration of the quality of the services delivered by such third parties could materially adversely affect our business and results of operations.

We plan to use third-party contractors for certain of our manufacturing activities. Our agreements with these manufacturers may require us to commit to purchase services based on forecasted product needs, which may be inaccurate, and, in some cases, require longer-term commitments. We may be also dependent upon a limited number of highly specialized third-party suppliers for required components and materials for certain of our key technologies. Arranging for replacement manufacturers and suppliers can be time consuming and costly, and the number of qualified alternative providers can be extremely limited. Our business operations, productivity and customer relations could be materially adversely affected if these contractual relationships were disrupted or terminated, the cost of such services increased significantly, the quality of the services provided deteriorated or our forecasted needs proved to be materially incorrect.

Natural disasters and other business disruptions could cause significant harm to our business operations and facilities and could adversely affect our supply chain and our customer base, any of which may materially adversely affect our business, results of operation, and financial condition.

We expect that our manufacturing and other facilities, as well as the operations of our third-party suppliers, are susceptible to losses and interruptions caused by floods, hurricanes, earthquakes, typhoons, and similar natural disasters, as well as power outages, telecommunications failures, industrial accidents, and similar events. The occurrence of natural disasters in any of the regions in which we or our suppliers will operate could severely disrupt the operations of our businesses by negatively impacting our supply chain, our ability to deliver products, and the cost of our products. Such events can negatively impact revenue and earnings and can significantly impact cash flow, both from decreased revenue and from increased costs associated with the event. In addition, these events could cause consumer confidence and spending to decrease. We may in the future carry insurance to generally compensate for losses of the type noted above, however, even if we obtain such insurance it may not be adequate to cover all losses that may be incurred or continue to be available in the affected area at commercially reasonable rates and terms. To the extent any losses from natural disasters or other business disruptions are not covered by insurance, any costs, write-downs, impairments and decreased revenue can materially adversely affect our business, our results of operations and our financial condition.

19

We may be subject to litigation from time to time during the normal course of business, which may adversely affect our business, financial condition and results of operations.

From time to time in the normal course of business or otherwise, we may become subject to litigation that may result in liability material to our financial statements as a whole or may negatively affect our operating results if changes to business operation are required. The cost to defend such litigation may be significant and may require a diversion of our resources. There also may be adverse publicity associated with litigation that could negatively affect customer perception of our products and business, regardless of whether the allegations are valid or whether we are ultimately found liable. As a result, litigation may adversely affect our business, financial condition and results of operations.

There is no assurance on the future successful completion of strategic transactions by us to successfully implement our business strategies.

Our ability to complete future strategic transactions could be important to the successful implementation of our business strategies, including our strategies to strengthen our geographic diversity and broaden its customer base. Successful completion of an acquisition or other similar transaction depends on a number of factors that are not entirely within our control, including our ability to negotiate acceptable terms, conclude satisfactory agreements and obtain all necessary regulatory approvals. In seeking to acquire a target company, we may face competition from other companies interested in acquiring the target company that have significantly greater financial and other resources than us. If we need to finance a transaction, we may not be able to obtain the necessary financing on satisfactory terms and within the timeframe that would permit the transaction to proceed. If any of these factors prevents us from completing one or more strategic transactions, we may not be able to expand our business in the manner and on the schedule that we plan. In addition, we may incur significant costs arising from our efforts to engage in strategic transactions. These costs may exceed the returns that we realize from a given transaction. Moreover, these expenditures may not result in the successful completion of a transaction.

Even if we complete one or more strategic transactions, we may be unable to integrate successfully the personnel and operations of a new business or achieve the operational synergies or other benefits that we had anticipated. Moreover, we might fail to discover liabilities of a business or operating or other problems prior to completing a transaction. We could experience adverse accounting and financial consequences, such as the need to make large provisions against the acquired assets or to write down acquired assets. We might also experience a dilutive effect on our earnings. Depending on how any such transaction is structured, there may be an adverse impact on our capital structure. Further, an acquisition could disrupt our ongoing business, distract management and employees or lead to increased expenses.

Risks Related to the Semiconductor Industry

The semiconductor industry is highly competitive, and our inability to compete effectively could materially adversely affect our business and results of operations.

The semiconductor industry is highly competitive, and our ability to compete successfully depends on elements both within and outside of our control. We will face significant competition from major global semiconductor companies as well as smaller companies focused on specific market niches. In addition, companies not currently in direct competition with us may introduce competing products in the future.

Our inability to compete effectively could materially adversely affect our business and results of operations. Products or technologies developed by competitors that are larger and have more substantial research and development budgets, or that are smaller and more targeted in their development efforts, may render our products or technologies obsolete or noncompetitive. We also may be unable to market and sell our products if they are not competitive on the basis of price, quality, technical performance, features, system compatibility, customized design, innovation, availability, delivery timing and reliability. If we fail to compete effectively on developing strategic relationships with customers and customer sales and technical support, our sales and revenue may be materially adversely affected. Competitive pressures may limit our ability to raise prices, and any inability to maintain revenue or raise prices to offset increases in costs could have a significant adverse effect on our gross margin. Reduced sales and lower gross margins would materially adversely affect our business and results of operations.

20

The semiconductor industry has experienced rapid consolidation and our inability to compete with large competitors or failure to identify attractive opportunities to consolidate may materially adversely affect our business.

The semiconductor industry is characterized by the high costs associated with developing marketable products and manufacturing technologies as well as high levels of investment in production capabilities. As a result, the semiconductor industry has experienced, and may continue to experience, significant consolidation among companies and vertical integration among customers. Larger competitors resulting from consolidations may have certain advantages over us, including, but not limited to: substantially greater financial and other resources with which to withstand adverse economic or market conditions and pursue development, engineering, manufacturing, marketing and distribution of their products; longer independent operating histories; presence in key markets; patent protection; and greater name recognition. In addition, we may be at a competitive disadvantage to our peers if we fail to identify attractive opportunities to acquire companies to expand our business. Consolidation among our competitors and integration among our customers could erode our market share, negatively impact our capacity to compete and require us to restructure our operations, any of which would have a material adverse effect on our business.

Downturns or volatility in general economic conditions could have a material adverse effect on our business and results of operations.

In recent years, worldwide semiconductor industry sales have tracked the impact of the financial crisis, subsequent recovery and persistent economic uncertainty. We believe that the state of economic conditions in the United States is particularly uncertain due to the global pandemic as well as recent and expected shifts in legislative and regulatory conditions concerning, among other matters, international trade and taxation, and that an uneven recovery or a renewed global downturn may put pressure on our sales due to reductions in customer demand as well as customers deferring purchases. Volatile and/or uncertain economic conditions can adversely impact sales and profitability and make it difficult for us and our competitors to accurately forecast and plan our future business activities. To the extent we incorrectly plan for favorable economic conditions that do not materialize or take longer to materialize than expected, we may face oversupply of our products relative to customer demand. Reduced customer spending may in the future drive us and our competitors, to reduce product pricing, which will result in a negative effect on gross profit. Moreover, volatility in revenue as a result of unpredictable economic conditions may alter our anticipated working capital needs and interfere with our short-term and long-term strategies. To the extent that our sales, profitability and strategies are negatively affected by downturns or volatility in general economic conditions, our business and results of operations may be materially adversely affected.

The semiconductor industry is highly cyclical, and significant downturns or upturns in customer demand can materially adversely affect our business and results of operations.

The semiconductor industry is highly cyclical and, as a result, is subject to significant downturns and upturns in customer demand for semiconductors and related products. We cannot accurately predict the timing of future downturns and upturns in the semiconductor industry or how severe and prolonged these conditions might be. Significant downturns often occur in connection with, or in anticipation of, maturing product cycles (for semiconductors and for the end-user products in which they are used) or declines in general economic conditions and can result in reduced product demand, production overcapacity, high inventory levels and accelerated erosion of average selling prices, any of which could materially adversely affect our operating results as a result of increased operating expenses outpacing decreased revenue, reduced margins, underutilization of our manufacturing capacity and/or asset impairment charges. On the other hand, significant upturns can cause us to be unable to satisfy demand in a timely and cost efficient manner. In the event of such an upturn, we may not be able to expand our workforce and operations in a sufficiently timely manner, procure adequate resources and raw materials, or locate suitable third-party suppliers to respond effectively to changes in demand for our existing products or to the demand for new products requested by our customers, and our business and results of operations could be materially and adversely affected.

21

Rapid innovation and short product life cycles in the semiconductor industry can result in price erosion of older products, which may materially adversely affect our business and results of operations.

The semiconductor industry is characterized by rapid innovation and short product life cycles, which often results in price erosion, especially with respect to products containing older technology. Products are frequently replaced by more technologically advanced substitutes and, as demand for older technology falls, the price at which such products can be sold drops, in some cases precipitously. In addition, our and our competitors’ excess inventory levels can accelerate general price erosion.

Shortages or increased prices of raw materials could materially adversely affect our results of operations.

Our manufacturing processes will rely on many raw materials. Generally, we expect that our agreements with suppliers of raw materials will impose no minimum or continuing supply obligations, and we will obtain our raw materials and supplies from a large number of sources on a just-in-time basis. From time to time, suppliers of raw materials may extend lead times, limit supplies or increase prices due to capacity constraints or other factors beyond our control. Shortages could occur in various essential raw materials due to interruption of supply or increased demand. If we are unable to obtain adequate supplies of raw materials in a timely manner, the costs of our raw materials increase significantly, their quality deteriorates or they give rise to compatibility or performance issues in our products, our results of operations could be materially adversely affected.

Our facilities and processes may be interdependent and an operational disruption at any particular facility could have a material adverse effect on our ability to produce our products, which would materially adversely affect our business and results of operations.